Your taxes (*almost) just went up

"In its meeting on Aug. 26 — after a public hearing was held on Aug. 19 — the Iron County School District Board of Education approved a modest property tax increase. Despite the district’s efforts to follow the Truth in Taxation process, the Utah State Tax Commission issued a letter on Sept. 19 informing ICSD that it failed to meet a new requirement of the code, 59-2-919(8), which states “A public hearing shall be available for individuals to attend or participate either in person or remotely through electronic means.” Even though the district livestreamed the public hearing on YouTube, which made it available for taxpayers to attend or participate remotely, the tax commission’s interpretation of this requirement resulted in the denial of the adopted certified tax rate.

The school district was informed by the tax commission that over 60 percent of the entities across the state that went through the Truth in Taxation process were also denied for various reasons."

On August 19, 2025, Iron County School District (ICSD) held its required Truth in Taxation hearing, proposing a property tax increase: an additional $2.46 million annually. For a home valued at $431,000, that translates to an increase from $630.08 to $699.77 per year - a jump of $69.69.

Then, at the August 26 board meeting, after hours of reports, discussion, and public comments, the board voted to adopt the tax increase along with the FY26 budget in a 5-2 vote. The votes were as follows:

- Board President Mr. Ben Johnson - Yes

- Board Vice President Mrs. Michelle Tullis - Yes

- Board Member Mr. John Taylor - Yes

- Board Member Mr. Tyrel Eddy - No

- Board Member Ms./Mrs. Stephanie Hill - No

- Board Member Mrs. Tiffiney Christiansen - Yes

- Board Member Mrs. Megen Ralphs - Yes

Both meetings are recorded and available on YouTube (August 19, August 26). If you watch any part, start with the public comment sections. Citizens showed up in force - educators, parents, retirees, and community leaders - making it clear of their stance on the issue.

The August 26th meeting also had an information session regarding how School Districts in the State of Utah are funded, presented by Senator Evan Vickers and Representative Rex Shipp.

What Stood Out in These Meetings

Note: All links to the YouTube recordings should take you to the moment in time being referenced in this article.

Several moments deserve attention:

- Board Member Tyrel Eddy’s Push for Clarity

At the August 19 meeting, he asked:

“Can any board member tell me a single actual line item that the $358,000 will go to, or the $2.23 million?”

The silence was telling. Eddy argued the vote should wait until such details were clear, and noted:

“If we do nothing, the state will subsidize us to the tune of $6.5 million. We have an opportunity to spare the community $8 million over the next four years.” - Business Administrator Todd Hess’ Analogy

At the August 26 meeting, when asked about delaying, Hess compared the district’s position to receiving a tax refund and increasing one’s standard of living with temporary money, warning that it’s hard to cut back later. That analogy hit home for many: citizens are required to live within their means. Why not the district? - Public Concerns About Overspending

Repeated comments referenced the $2.69 million in bonuses handed out just 9 months ago (December, 2024 – see the third page of the attachments below under "Other Possible Cuts"). To many, that windfall is directly connected to this increase: spend beyond your means, then make it up through taxes. That’s not fiscal conservatism. - Other key concerns:

- An alleged surplus of $33M

- No clear indication of how the funds will be used, other than vague responses such as "increased costs of operation", with a wide net of citations of how much various programs cost to operate

- No address or apology to the community by the District's Administration, despite our pleading for a delay or more careful analysis

The Core Issue: Uncertainty

What struck me most was that both sides of this debate are reacting to the same problem: uncertainty.

- The district says: “We can’t predict what the economy or state funding will do - so we need this increase now to maintain stability.”

- The community says: “Exactly. You don’t know what’s coming - so don’t raise taxes when families are barely holding on.”

There’s no crystal ball. That much everyone agrees on. But when uncertainty is used as a reason to take more from taxpayers, rather than a reason to exercise restraint, it feels less like prudence and more like pressure.

The Human Side of This Debate

Here’s how I feel:

- “Tour the schools, they say. ‘Tour the community,’ I say.”

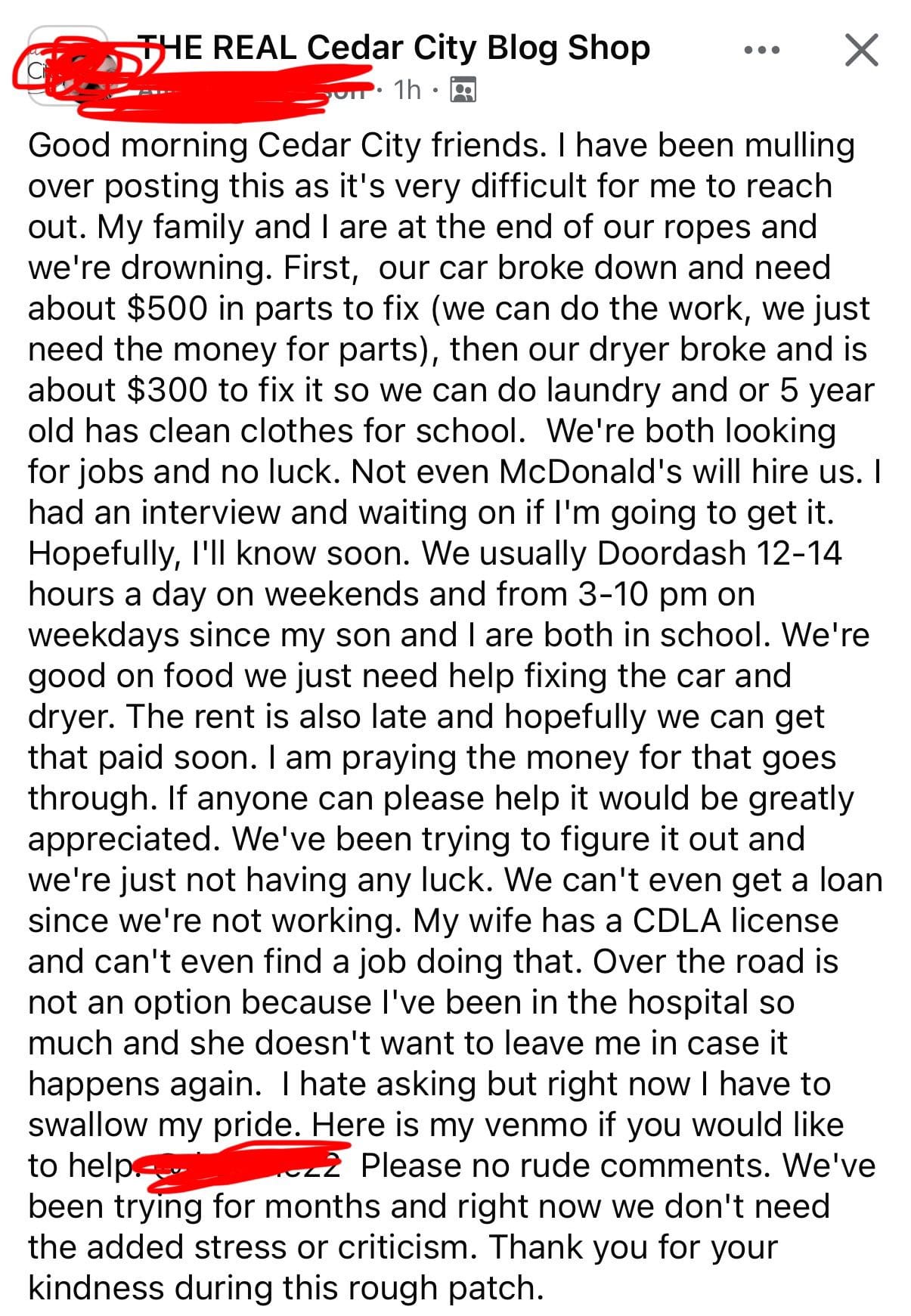

Families are struggling. College students, single parents, retirees - hundreds of stories shared online and in person about scraping by, filling gas tanks for neighbors, donating pet food so animals don’t go hungry. Clothes for expecting moms that can't afford a maternity wardrobe. The same people being told to “chip in a little more” are often the ones quietly holding this community together, or they're the ones falling apart. I have now amassed over 300 Iron County examples of folks struggling in the past 10 months.

- “Not a single one of us is anti-education or wants our children to suffer. But there was no compromise, not even a chance.”

That sentiment ran deep. Many residents asked why the board couldn’t scale back the request, phase it in, or offset costs by reducing nonessential spending: especially when the amount requested nearly mirrors the annual bonuses given in December of 2024.

My Perspective

This tax hike may seem small on paper - $70 per year - but for families already budgeting down to the last dollar, it’s another straw on a heavily burdened camel. When inflation and housing costs are climbing, every added bill matters.

What’s more troubling is the pattern of decision-making:

- No crystal-clear line items for where the money goes.

- A vote pushed through despite calls to delay and re-examine specifics.

- Justifications relying on “we can’t lose state funding,” even though evidence suggests otherwise.

This isn’t about being anti-school or anti-student. It’s about fiscal responsibility, transparency, and trust. When the community feels unheard, that trust erodes.

A Better Path Forward

- Line-Item Transparency

No more blanket comparisons to other districts or vague “needs.” Taxpayers deserve exact allocations before the vote, or it be forced to a ballot decision. Show the impact to the community. - Explore Alternatives

Could we defer projects, reduce administrative costs, or use reserves before tapping taxpayers again? - Respect Community Input

Public comment isn’t a formality. It’s feedback. When board members themselves say they weren’t ready to vote, that signals a process problem. All too often, we are thanked for our comment with no reciprocity to our concerns.

Closing Thought

This issue goes beyond one vote. It’s about how we govern, how we prioritize, and how we balance our shared responsibility to educate children with the economic reality most families face.

Yes, your taxes just went up. The question is: next time, will the community have a real say, or just a seat in the audience?

See the District's response to the board as to why they needed the funding below, prior to the August 26th vote that had passed.